Federal Income Tax Returns 2024. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Easily file federal and state income tax returns with 100% accuracy to get your maximum tax.

The where’s my refund tool lists the federal refund information the irs has from the past two years. The trend may not hold, as refund.

The 2024 Tax Brackets Apply To Income Earned This Year, Which Is Reported On Tax Returns Filed In 2025.

Enter your income and location to estimate your tax burden.

As The End Of The Tax Season Approaches, Millions Of Americans Who Are Yet To File Their Returns Can Do.

10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

The Average Tax Refund Issued By The Irs As Of March 1 Is $3,182, A 5.1% Increase Compared To The Similar Filling Period In 2023.

Images References :

Source: imagesee.biz

Source: imagesee.biz

What Are The 2020 2021 Federal Tax Brackets And Rates Gobankingrates, Page last reviewed or updated: Updated sat, feb 3, 2024, 11:07 am 3 min read.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

IRS Refund Schedule 2024 When To Expect Your Tax Refund, Enter your income and location to estimate your tax burden. Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2023 tax return in 2024.

Source: patch.com

Source: patch.com

2023 Tax Season Opens In WA When To File 2022 Returns With IRS, Washington — the internal revenue service today announced monday, jan. This was the basis for the estimated 2024 irs refund schedule/calendar shown below, which has been updated to reflect the jan 29th, 2024 start date of irs tax.

Source: investorinsights360.com

Source: investorinsights360.com

Federal Tax Earnings Brackets For 2023 And 2024 Investor Insights 360, Page last reviewed or updated: Updated sat, feb 3, 2024, 11:07 am 3 min read.

Source: www.nj.com

Source: www.nj.com

Here’s when you can begin filing federal tax returns, and why the IRS, Enter your income and location to estimate your tax burden. The irs expects more than 128.7.

Source: www.dykema.com

Source: www.dykema.com

IRS Clarifies Federal Tax Impact of Special State Payments Dykema, See current federal tax brackets and rates based on your income and filing status. For most of us, the last day to file a 2023 federal income tax return was monday, april 15, 2024.

Source: biz.libretexts.org

Source: biz.libretexts.org

6.2 The U.S. Federal Tax Process Business LibreTexts, Page last reviewed or updated: The irs expects more than 146 million individual tax returns for 2023 to be filed this filing season, which has a deadline of april 15, 2024.

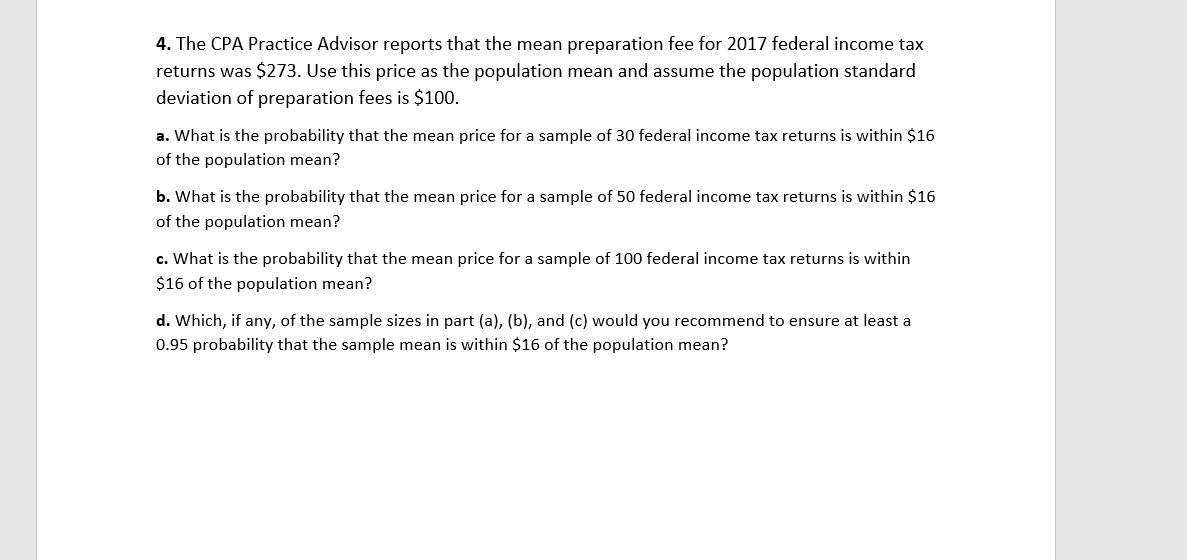

Source: www.chegg.com

Source: www.chegg.com

Solved 4. The CPA Practice Advisor reports that the mean, As the end of the tax season approaches, millions of americans who are yet to file their returns can do. Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2023 tax return in 2024.

Source: www.pinterest.com

Source: www.pinterest.com

The Complete List of Tax Credits for Individuals Tax credits, Federal, If you file on paper, you should receive your income tax package in the mail by this date. See current federal tax brackets and rates based on your income and filing status.

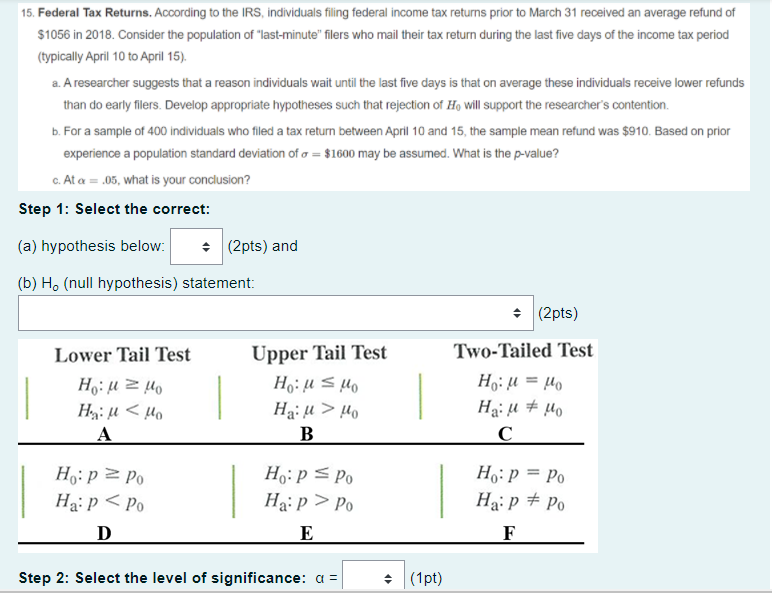

Source: www.chegg.com

Source: www.chegg.com

Solved 15. Federal Tax Returns. According to the IRS,, Where to send tax returns 2024: Our free tax calculator will help you estimate how much you might expect to either owe in federal taxes or receive as a tax refund when filing your 2023 tax return in 2024.

This Was The Basis For The Estimated 2024 Irs Refund Schedule/Calendar Shown Below, Which Has Been Updated To Reflect The Jan 29Th, 2024 Start Date Of Irs Tax.

The tax items for tax year 2024 of greatest interest to most.

The Irs Begins Accepting Tax Year 2023 Returns On Jan.

See your personalized refund date as soon as the irs processes your tax return and approves your refund.